In February, Maxar surprised many people outside the company when we announced we would keep our SSL satellite manufacturing business and restructure its operations to be more nimble and efficient, continuing to deliver on our commitments while returning to profitability. We renamed it Maxar Space Solutions, and we believe this organization is poised to transform the markets that it serves, in particular the U.S. Government, which is expressing much more interest in leveraging commercial innovation and affordability.

Maxar’s strategy all along was to diversify its satellite manufacturing business. Key to this was access to the U.S. Government, enabled by the acquisition of DigitalGlobe and by “domestication” (becoming a U.S. company, which happened this past January). The steep decline in the geosynchronous communication satellite market drove a sense of urgency for us to assess whether this strategy was still the right one. The very public airing of the strategic alternatives under consideration for our spacecraft manufacturing group was regrettable, creating needless uncertainty for our team members and our customers.

With Dan Jablonsky’s appointment as Maxar’s CEO in January, we took a fresh look at the situation based on broader customer needs and market opportunities. We concluded—as had been the strategy all along, and is probably not surprising in retrospect—that these capabilities have more value to Maxar than any prospective buyers were willing to pay, and that the costs and risks associated with winding down the business would have been highly disruptive for our team members and unattractive for our investors. We also heard from our customers how much they need us to be here for them, and we confirmed how integral Space Solutions is to Maxar’s strategy of delivering end-to-end space solutions.

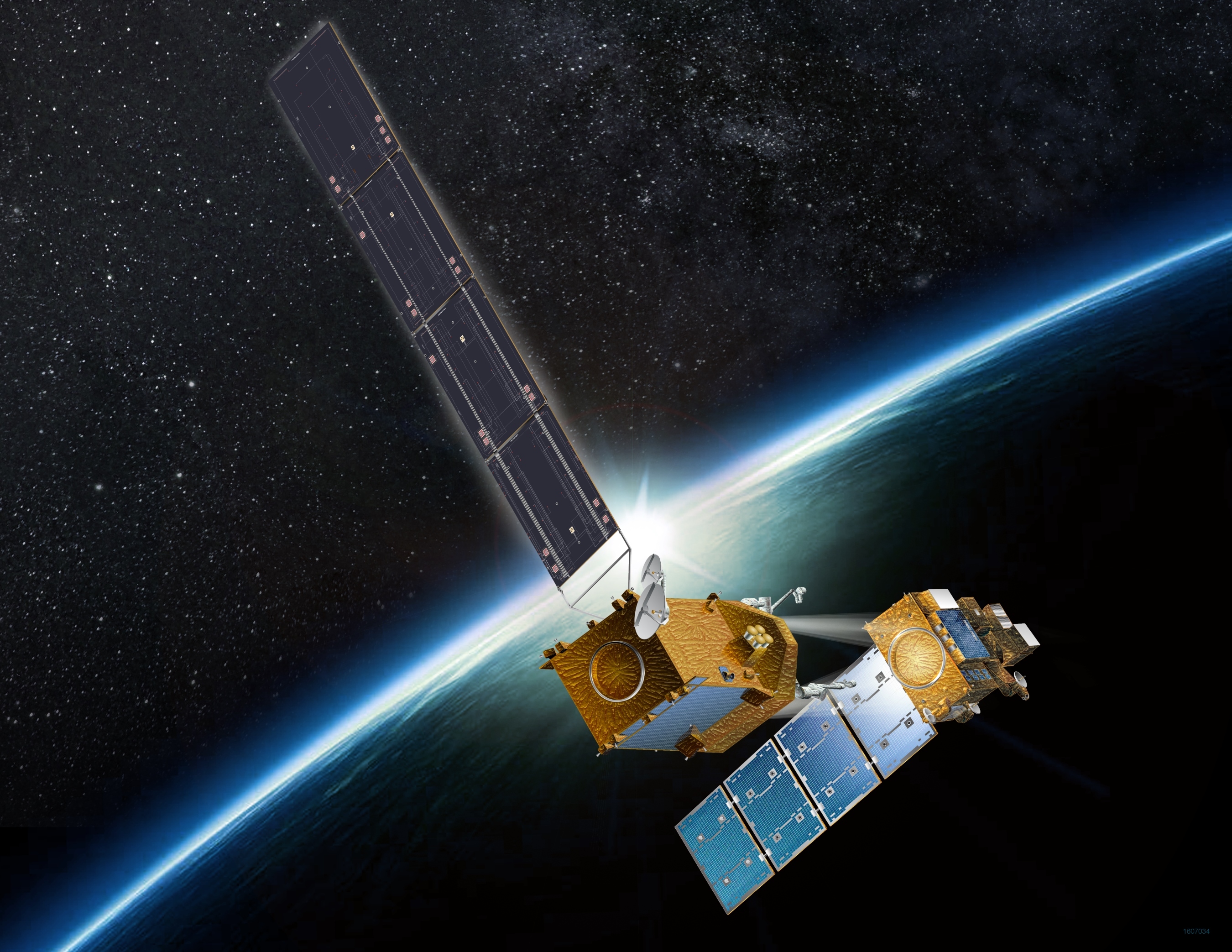

Maxar Space Solutions is a gem. It’s one of the very few aerospace companies where the bulk of its business has been commercial, forcing it to be very cost-competitive while delivering a tremendous track record of on-orbit success—and it would be very hard to replicate. Over the last eight months we’ve received positive customer feedback that Space Solutions’ Legion-class spacecraft bus will be very competitive for a broad spectrum of U.S. Government missions. We are pursuing several commercial geosynchronous communications satellite opportunities that would leverage our industry-leading 1300 spacecraft bus. The 1300 is also perfectly suited for government missions we hope to support, such as the Power Propulsion Element module that will be the first building block for NASA’s Lunar Gateway program.

While we pursue those new opportunities, there is much work to be done on existing programs. Last month we were excited to complete the Preliminary Design Review for the 1300-derived Psyche spacecraft we’re building for NASA that will be the first to explore asteroid made of metal rather than rock or ice in 2022. And just last week we completed the Critical Design Review for the Restore-L spacecraft that we’re building for NASA, which will rendezvous with and refuel the Landsat 7 satellite. We’re also developing two robotic arms for the mission at our Pasadena facility.

On the commercial side, we’re getting ready to ship the EUTELSAT 7C GEO communications satellite, which will be our first to feature all-electric propulsion technology. This type of propulsion system reduces overall spacecraft mass, allowing our satellites to carry larger payloads or fly on smaller launch vehicles. We’ll also complete the Intelsat 39 satellite this spring, to be followed by satellites for Sirius XM, Hughes Network Systems, Embratel Star One and B-SAT.

Space Solutions’ commercial mindset is its differentiator that allows us to grow our business with the U.S. Government. WorldView Legion, on track for its first launch in Q1 2021, is a great example of this. DigitalGlobe’s most recent satellite, WorldView-4, cost $850 million and weighed about 2,500 kg. WorldView Legion satellites are smaller at around 750 kg, and the multi-satellite system will cost just $600 million to build and launch—and will deliver 3x the high resolution capacity of WorldView-4 over the highest demand regions on the planet. It is truly a disruptive capability that will allow DigitalGlobe to image the Earth from sunrise to sunset while being more capital efficient—by more than an order of magnitude—than any current or planned Earth observation system.

To deliver on our strategy, an intense focus on high-quality execution is paramount. We will deliver on our backlog. We will win new business with our existing satellite platforms and robotics capabilities, leveraging Maxar’s global sales channels. We will transform the business to be more scalable and better able to weather market cycles and address market trends. And we will leverage enterprise-wise processes, infrastructure systems, and the capabilities across the whole of Maxar to deliver system-level solutions.

Space Solutions has a 61-year legacy of developing the most incredible space systems, from the iconic high-gain antenna for NASA’s Voyager 1 spacecraft that has travelled farther from Earth than any other object ever made by humankind and is still communicating back to us, to all five of the robotic arms that have operated on the surface of Mars. But we are not resting on our rich heritage. We will execute on our strategic plans, we will meet our commitments, and we will ensure future growth that will establish our best years still to come.

Top image: Enabled by the Power Propulsion Element module, NASA’s lunar Gateway will function as an access point to the Moon and beyond. (courtesy of NASA)