Chinese Lending and Debt Distress in Sub-Saharan Africa

Sub-Saharan Africa is suffering through some extremely difficult growing pains. The region is predicted to experience the largest population growth of any part of the world over the next 30 years. But, it’s also the poorest region in the world, severely restricting their ability to adequately prepare for this explosive population growth. Some argue that China has aggressively capitalized on the opportunity presented by this crisis. China’s Belt and Road Initiative (BRI) has brought massive infrastructure and communications development to sub-Saharan Africa—along with equally massive debt and the looming possibility of debt-trap diplomacy.

This month’s Maxar Spotlight examines the regional and global impacts of China’s Belt and Road efforts in sub-Saharan Africa through Maxar’s unique technological perspective. By combining the industry’s most accurate and reliable high-resolution satellite imagery with cutting-edge geospatial insights from our Persistent Change Monitoring and our Human Landscape datasets, Maxar provides our government and commercial partners with the information they need to rapidly analyze and investigate recent developments in the region.

How can you visualize the scope of Chinese investments in Africa and understand their potential ramifications for the region and the world? Get the picture on the ground and from space with this month’s Maxar Spotlight.

One Maxar.

Unlocking the promise of space to confront challenges on Earth—and beyond.

Fill out the form to access the latest edition and subscribe to the Spotlight:

Sneak Peek: (excerpt from Maxar Spotlight)

China’s transportation investments and strong trading relationship with sub-Saharan Africa

China maintains a significant presence and strong trading relationship with many of the countries that have received substantial loans. Angola, South Africa, Republic of the Congo, Democratic Republic of Congo and Zambia are the top five exporters to China across sub-Saharan Africa. In terms of importing from China, South Africa, Nigeria, Kenya and Ethiopia are among its strongest trading partners.

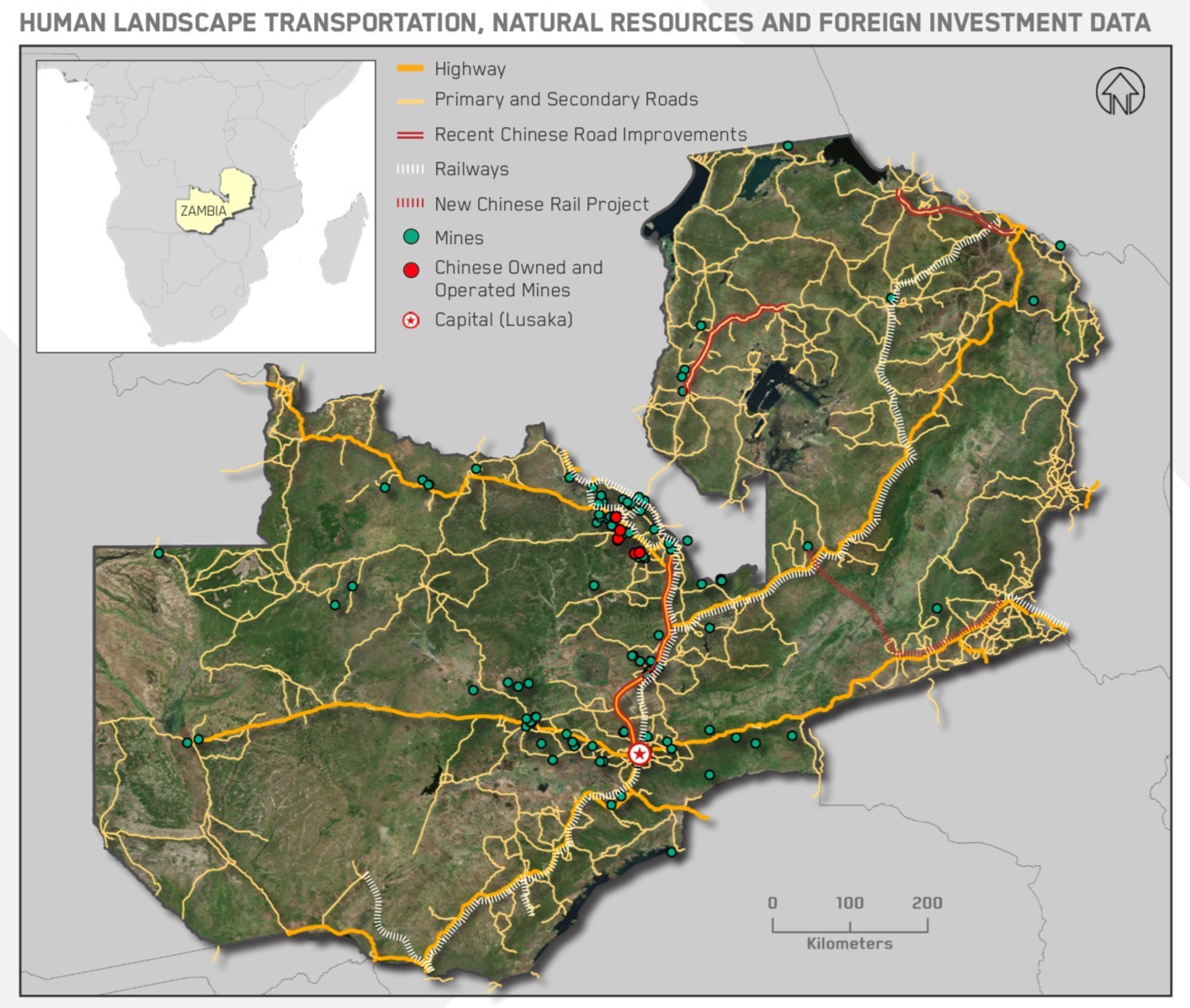

Analysis of Maxar’s Human Landscape dataset for Zambia demonstrates how transportation investments are being used to strategically access precious metals and mines, a number of which are operated by China. Zambia is the region’s second largest copper producer, having recently been surpassed by the Democratic Republic of Congo. Development of important transportation corridors will improve Zambia’s trade efficiency, and (in the case of rail improvements) expedite the transfer of mined materials to key ports in neighboring countries. There are also reports that China is interested in acquiring control over additional mines from other foreign investors and even the Zambian government, which still maintains a significant stake in all mines throughout the country.